open end mortgage definition

An Open-end Mortgage is a distinct sort of house loan in which the client can utilize the loan money as required even when theyve bought the property. Description of loan and secondary liability.

Loan Vs Mortgage Difference And Comparison Diffen

Open-end mortgage in American English.

. Open-end mortgage a mortgage under which the mortgagor borrower may secure additional funds from the mortgagee lender usually stipulating a ceiling amount that can be borrowed. An open-end mortgage is a type of home loan in which the total amount of the loan is not advanced all at once but rather used for future home-related improvements as needed. Generally an open-end mortgage is one that remains open after it has been delivered to the county recorder and it permits the lendermortgagee to make advances on the loan that are secured by the original mortgage but only to the extent the total indebtedness does not exceed the maximum principal amount identified.

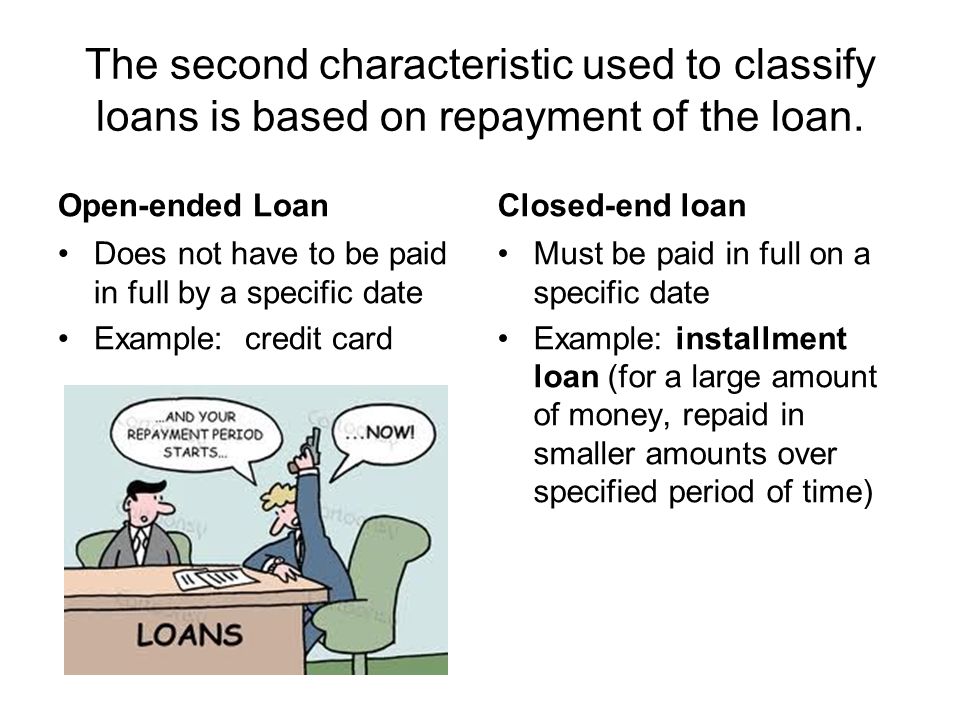

A mortgage loan that may allow future advances as the value of the property increases up to a certain percentage of loan-to-valueThe legal problem with this arrangement occurs when loan 1 is an open-end mortgage lender 2 loans money to the borrower and takes a second mortgage and then lender 1 advances additional money under its open. It is a type of rotating credit wherein the borrower is entitled to get top up on the same loan subject to a prescribed ceiling. An Open End Mortgage is a loan that is made available to the homeowner by a lender that is not a bank or a credit union.

Open-end mortgage saves borrower the effort of going somewhere else in search of a loan. The term open end is a misnomer as it does not restrict the borrower to one type of property. Open-end mortgage allows the borrower to borrow additional money on the same loan amount up to a certain limit.

The open-end mortgage is a type of mortgage that is more flexible for the mortgagee and more giving unlike a closed-end mortgage. A mortgage that provides for future advances on the mortgage and which. Open-end provisions often limit such borrowing to no more than the original loan amount.

A mortgage loan that may allow future advances as the value of the property increases up to a certain percentage of loan-to-valueThe legal problem with this arrangement occurs when loan 1 is an open-end mortgage lender 2 loans money to the borrower and takes a second mortgage and then lender 1 advances additional money under its open-end mortgage. It remains open and it permits the lender to make advances on the loan that are secured by the original mortgage. Upon request of the Borrowers the.

Open-end mortgages can provide flexibility but limit you to what you were initially approved for. Open End Mortgage A mortgage containing a clause which permits the mortgagor to borrow additional money up to the original amount of the loan after the loan has been reduced without rewriting the mortgage. Poole obtains an open-end mortgage to purchase a home.

It provides the borrower with just enough money to purchase a property just like a standard new mortgage. A mortgagee through an open-end mortgage can obtain a specific amount of money that is called a principal amount. Open-end mortgage definition a mortgage agreement against which new sums of money may be borrowed under certain conditions.

Open-end mortgages combine the benefits of a traditional mortgage and a HELOC. Open-end mortgage A mortgage which secures advances up to a maximum amount of indebtedness outstanding at any time stated in the mortgage plus accrued and unpaid interest. A mortgage that allows the borrowing of additional sums often on the condition that a stated ratio of collateral value to the debt be maintained.

However this scenario permits the lender to raise the loan balance at a future stage borrowing from it similarly to a. The first time the mortgagee takes out money they take out 50 as they are. This Security Instrument is given to secure the payment of the initial advance with interest as provided in the Note of even date with additional advances as hereinafter specified.

Most material 2005 1997 1991 by Penguin Random House LLC. Instead an Open End Mortgage allows a borrower to take out a loan against any type of property. An open-end mortgage allows individuals to borrow additional money on the same loan at a later date without having to take out new financing or credit.

What is an open-end mortgage. A If an open-end mortgage meets the requirements of this section such mortgage shall be deemed to give sufficient notice of the nature of the obligation to secure the obligation of any person who is. Connecticut General Statutes 49-4b Open-end mortgage as security for guaranty of an open-end loan.

A mortgage agreement against which new sums of money may be borrowed under certain conditions. An open-end mortgage is a mortgage with that allows the mortgagor to borrow additional money in the future without refinancing the loan or paying additional finance charges. An open-end mortgage is a type of mortgage that allows the borrower to increase the amount of the mortgage principal outstanding at a later time.

![]()

What Types Of Loans Are There Student Loan Hero

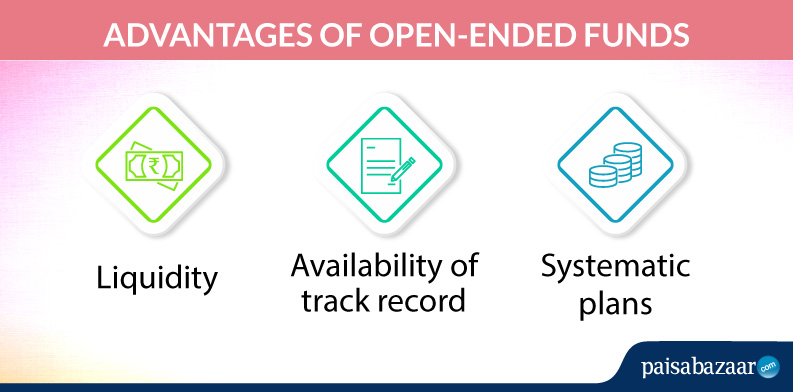

What Are Open Ended Funds Meaning Difference Advantage Disadvantage

Open End Mortgage Loan What Is It And How It Works

What Is A Closed End Signature Loan

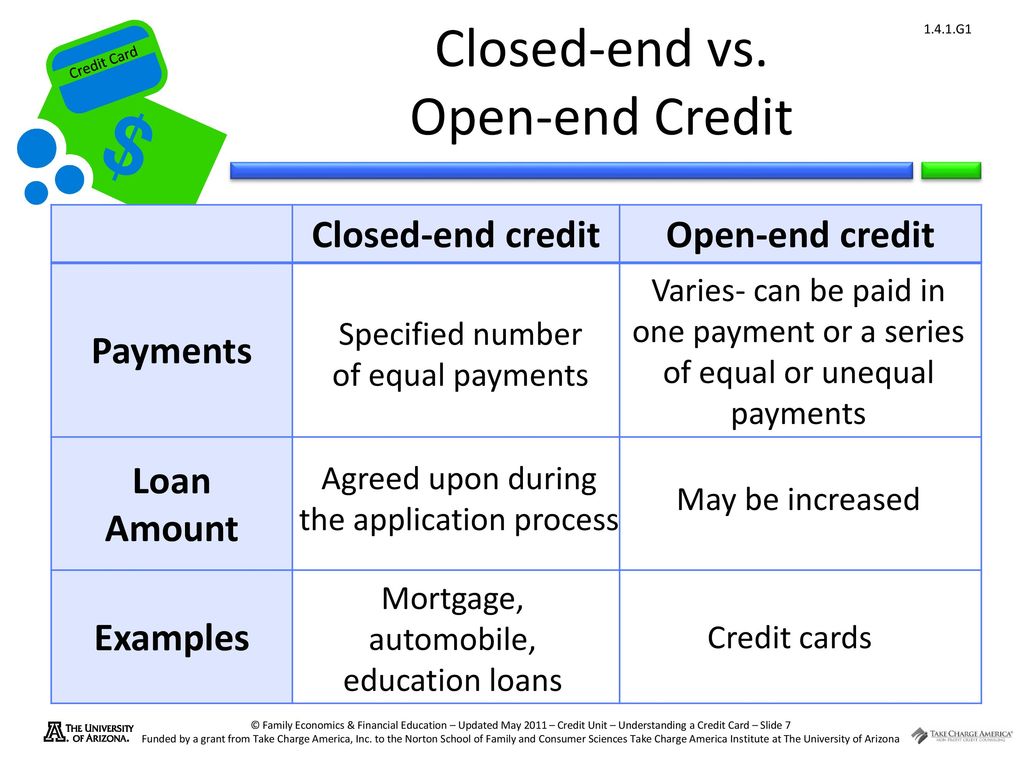

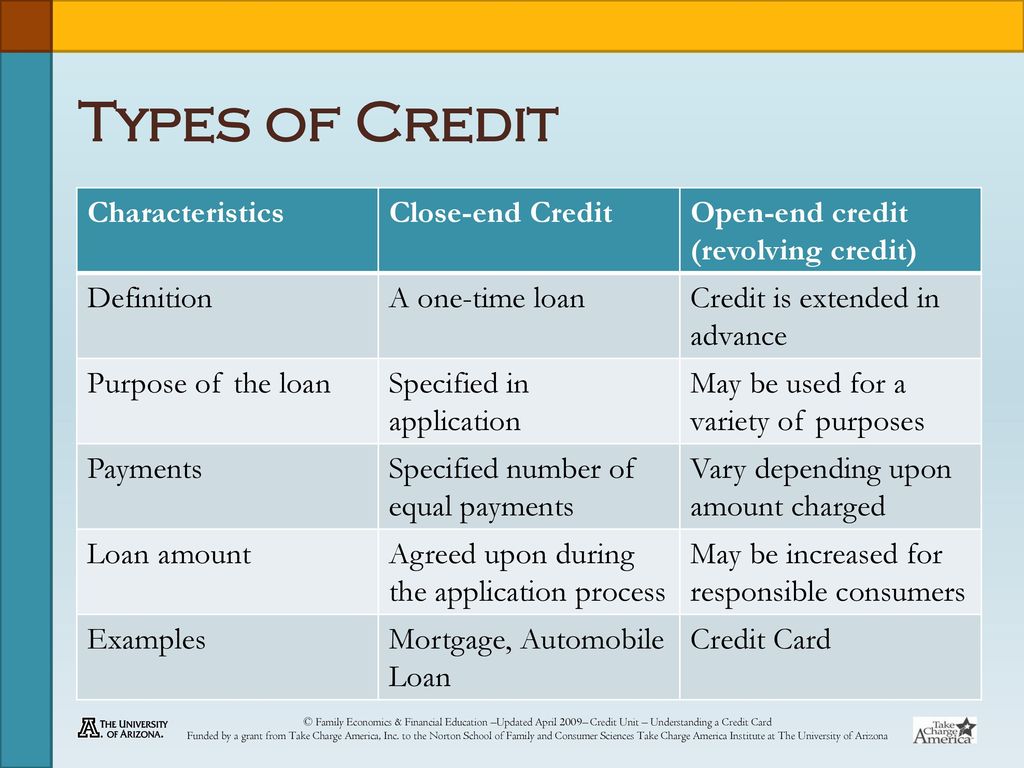

Understanding A Credit Card Take Charge Of Your Finances Advanced Level Ppt Download

Understanding A Credit Card Ppt Download

Understanding A Credit Card Ppt Download

Appendix G To Part 1026 Open End Model Forms And Clauses Consumer Financial Protection Bureau

Lending Banking Finance Ppt Download

What Is Open End Credit Experian

Open End Mortgage Loan What Is It And How It Works

Open End Mortgage Loan What Is It And How It Works

What Is The Difference Between Closed And Open Ended Funds Quora

/GettyImages-1255233114-7ee229662f654529847000e3acf2a8e7.jpg)

/GettyImages-931812572-a67e660bd8c2476a9d7f87e76a97b158.jpg)

:max_bytes(150000):strip_icc()/bank-calculates-the-home-loan-rate-1144776052-750b11ef5e7d4c3dac0a6693e08d8fe8.jpg)