massachusetts estate tax rates table

Total Sales Tax Rate. Massachusetts has one of the highest average property tax rates in the country with only five states levying higher.

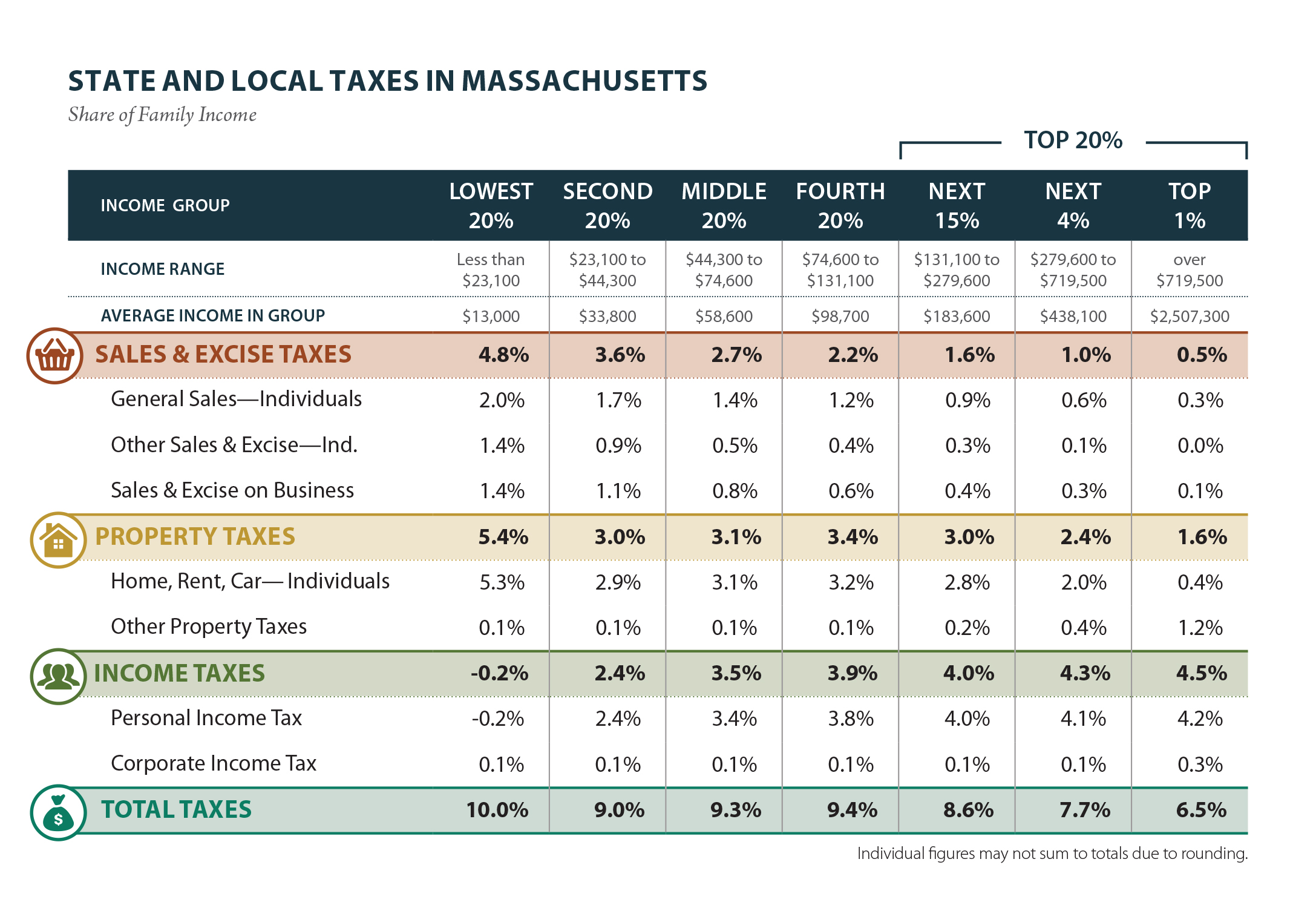

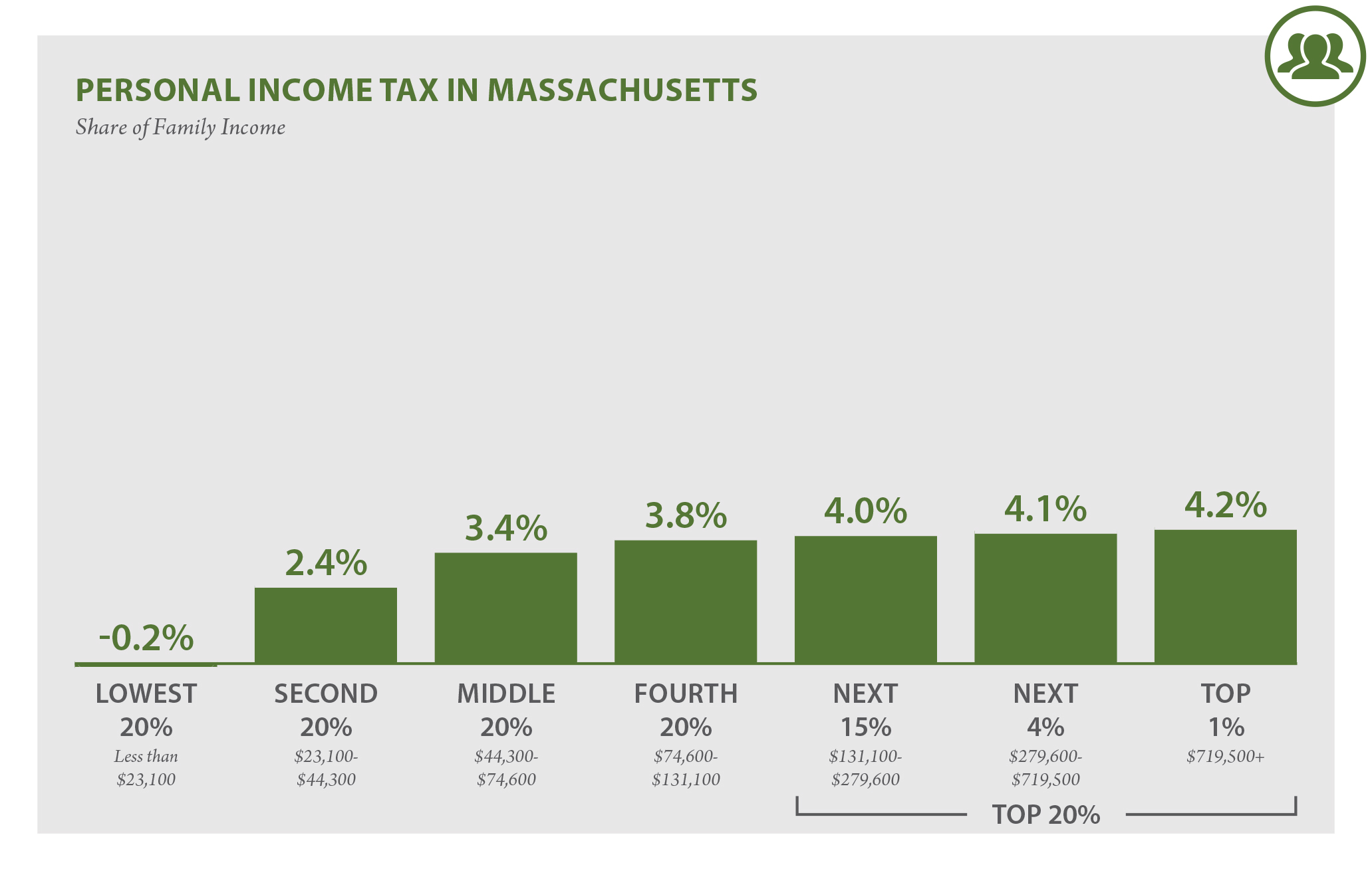

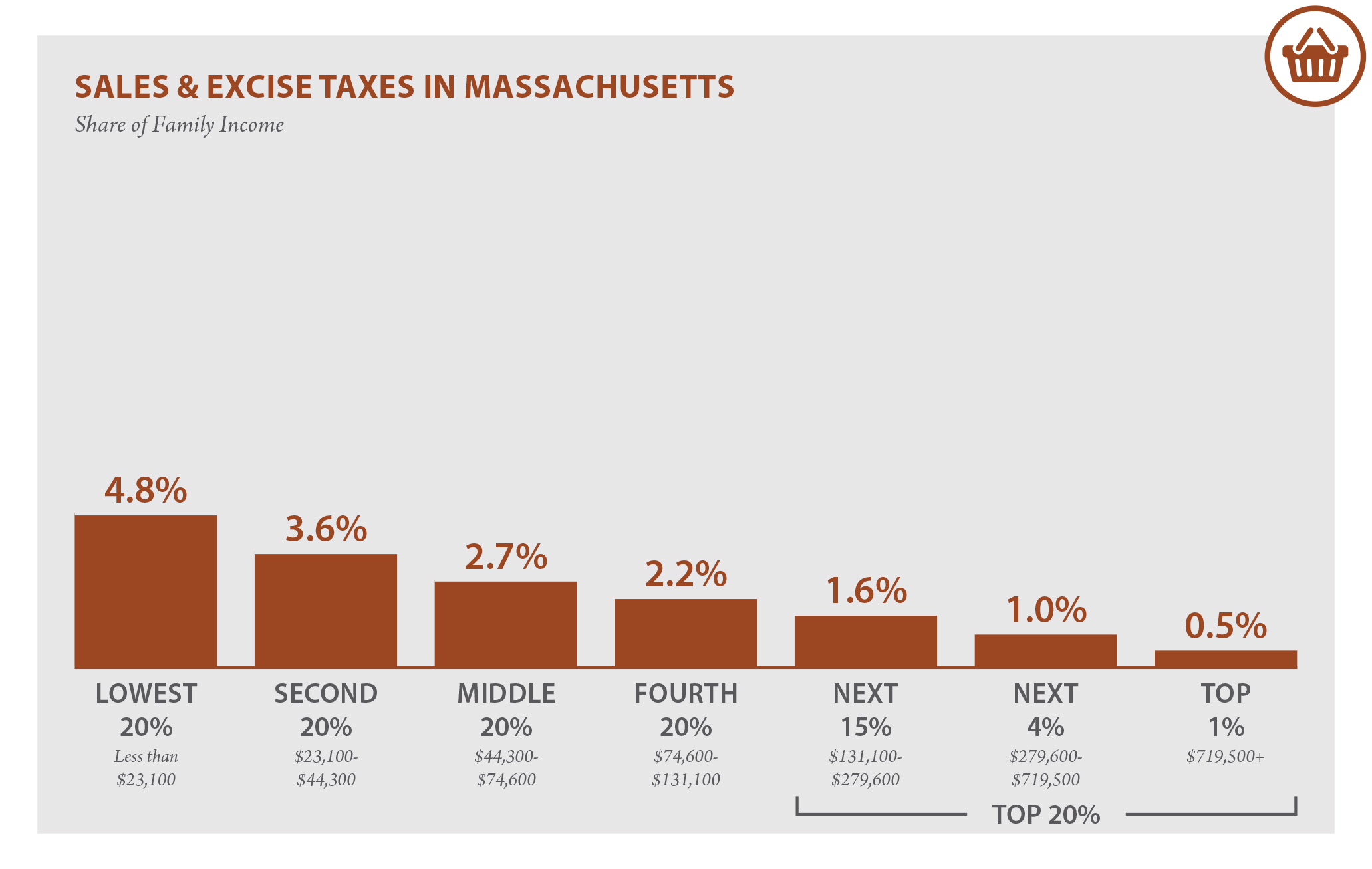

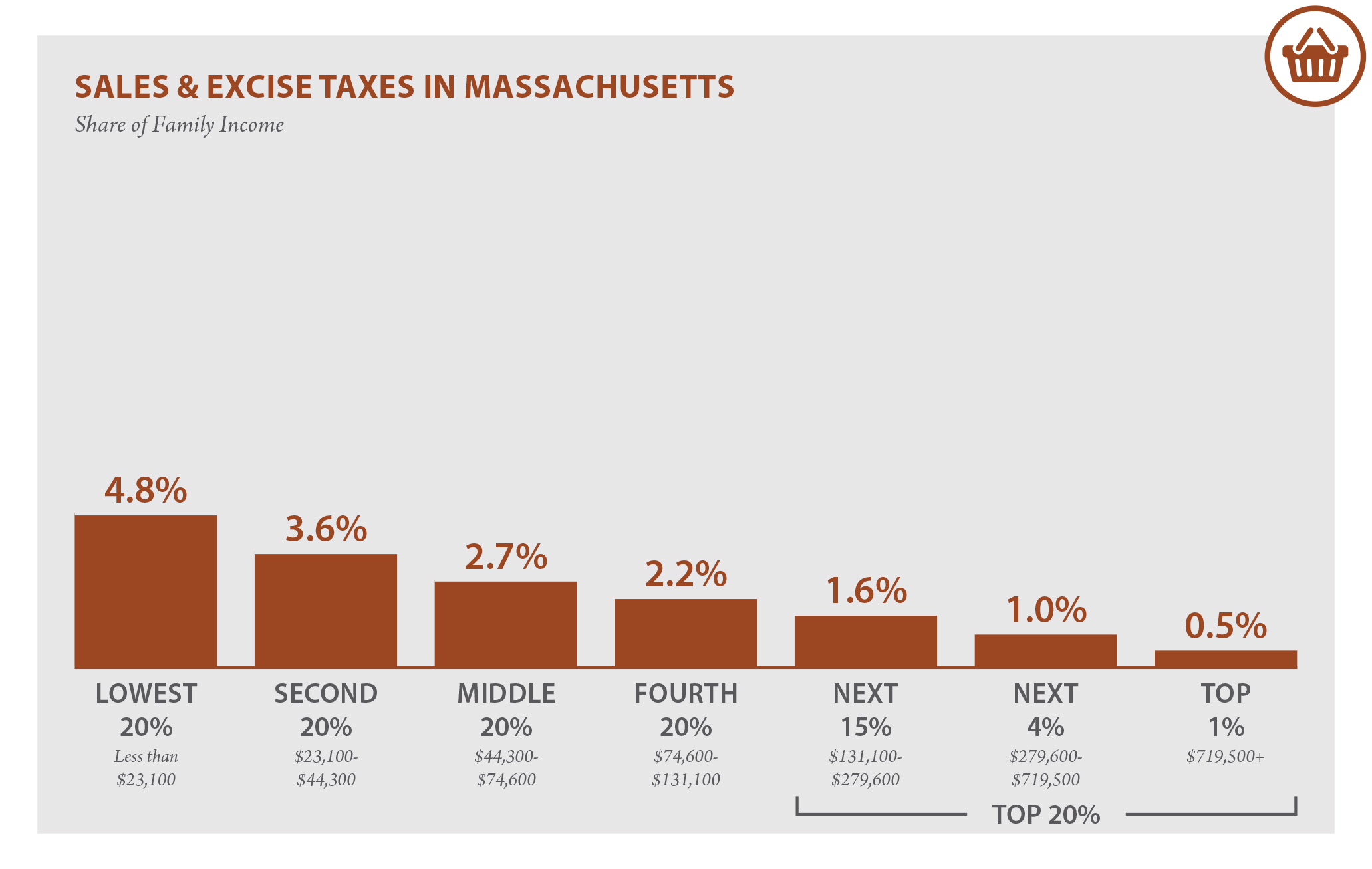

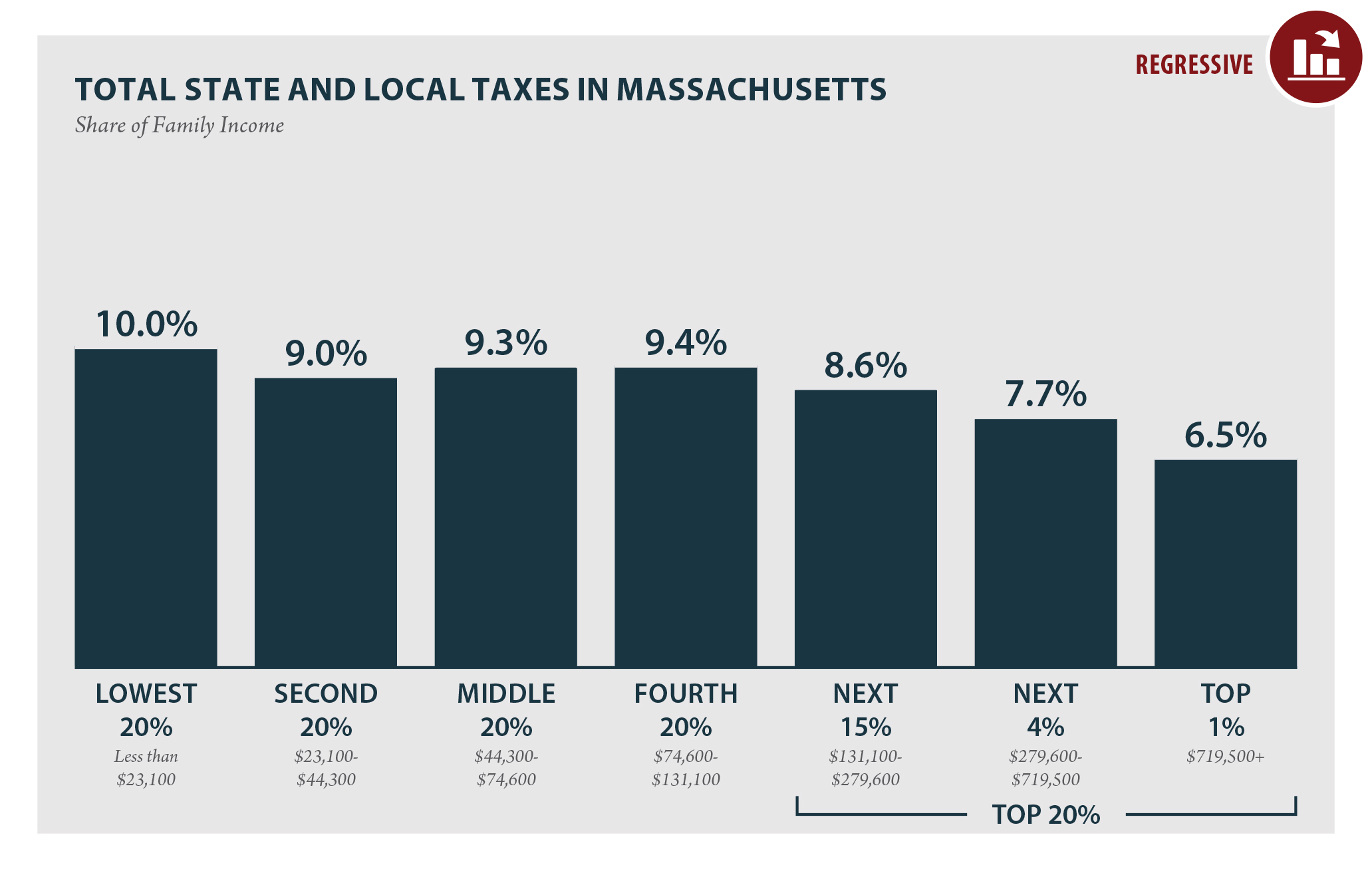

Massachusetts Who Pays 6th Edition Itep

Click the countys name in the data table above.

. Counties in Massachusetts collect an average of 104 of a propertys assesed fair market value as property tax per year. The maximum credit for state death taxes is 64400 38800 plus 25600. Ad Compare Your 2022 Tax Bracket vs.

Acushnet Center MA Sales Tax Rate. A properly crafted estate plan may. Alford MA Sales Tax Rate.

Compare these rates to the current federal rate of 40 Deadlines for Filing the Massachusetts Estate Tax Return. The towns in Worcester County MA with the highest 2022 property tax rates are Bolton 1987 Lancaster 1945 and Sturbridge 1915. This means if your estate is worth 15 million the tax applies to all 15 million not just the 500000 above the exemption.

Acushnet MA Sales Tax Rate. The median property tax in Massachusetts is 351100 per year for a home worth the median value of 33850000. 100800 290800 391600 tax.

The estate tax rate for Massachusetts is graduated. Agawam MA Sales Tax Rate. The credit on 400000 is 25600 400000 064.

If the estate is worth less than 1000000 you dont need to file a return or pay an estate tax. For the most up to date tax rates please visit the Commonwealth of Massachusetts. In this example 400000 is in excess of 1040000 1440000 less 1040000.

Your estate will only attract the 0 tax rate if its valued at 40000 and below. Up to 25 cash back If you were to translate the amount owed into a tax rate on the portion of the estate that exceeds the Massachusetts exemption amount of 1 million the top rate would be 16that is you would not be taxed more than 16. Massachusetts uses a graduated tax rate which ranges between 08 and a maximum of 16.

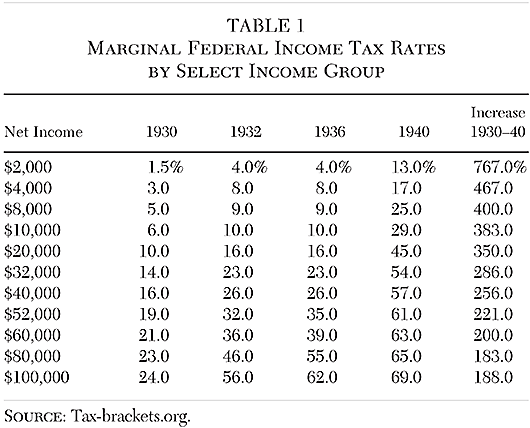

We also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. Discover Helpful Information and Resources on Taxes From AARP. 22 rows Massachusetts Estate Tax Rates.

Print This Table Next Table starting at 4780 Price Tax. Abington MA Sales Tax Rate. The Massachusetts State Tax Tables for 2022 displayed on this page are provided in support of the 2022 US Tax Calculator and the dedicated 2022 Massachusetts State Tax Calculator.

The average residential property tax rate for Worcester County is 1584. If the employee claims more than one exemption deduct 1000 times the number of exemptions plus 3400. Adams MA Sales Tax Rate.

2022 Massachusetts State Tax Tables. When the second of two spouses dies the exemption is still only 1 million. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios.

For a visual display of how property taxes compare in Massachusetts 14 counties. 73 rows The formula to calculate Massachusetts Property Taxes is Assessed Value x Property Tax. This tool is provided to help estimate potential estate taxes and should not be relied upon without the assistance of a qualified estate tax professional.

Estates with a net value of more than this pay an estate tax as high as 16. The average residential property tax rate for Worcester County is 1584. 352 rows Map of 2022 Massachusetts Property Tax Rates - Compare lowest and highest MA property taxes.

Unless specifically stated this calculator does not estimate separate estate or inheritance taxes which are levied in many states. The exemption is not portable between spouses. The three Worcester County towns with the lowest property taxes are Dudley 1170 Royalston 1221 and Oakham 1272.

An estate valued at 1 million will pay about 36500. If the employee claims one exemption only deduct 4400. The 2019 Massachusetts estate tax exemption is 1 million.

Massachusetts Estate Tax Rate. The state sales tax rate in massachusetts is 625 but you can customize this table as. Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower.

Updated February 22 2022. The Massachusetts estate tax is equal to the amount of the maximum credit for state death taxes. A Massachusetts estate tax return Form M-706 is required to be filed because the decedents estate exceeds the filing threshold.

Take note that there are Massachusetts estate tax rates on estates valued below 1000000 down to 40000. Everyone whose Massachusetts gross income is 8000 or. This data is based on a 5-year study of median property tax rates on owner-occupied homes in Massachusetts conducted from 2006 through 2010.

Your 2021 Tax Bracket to See Whats Been Adjusted. From Fisher Investments 40 years managing money and helping thousands of families. This means if the value of an estate exceeds the 1 million threshold anything above 40000 will be taxed.

5000000 - 60000 4940000. Acton MA Sales Tax Rate. Massachusetts Sales Tax Table at 625 - Prices from 100 to 4780.

Tax amount varies by county. These rates will apply if the Massachusetts estate tax exemption is used up or reduced for reasons we will get into later. Everything You Need to Know SmartAsset The Massachusetts estate tax rates range from 0 16 and apply to estates valued over 1 million.

Additionally because the taxable estate of 5000000 exceeds 1000000 the estate tax due is 391600. The rate for residential and commercial property is based on the dollar amount per every 1000 in assessed value. Accord MA Sales Tax Rate.

Using the table this tax is calculated as follows. Data sourced from the US. If youre responsible for the estate of someone who died you may need to file an estate tax return.

Allston MA Sales Tax Rate. Multiply the result of Step 8 by 500 percent to obtain the annual Massachusetts tax withholding. 2019 Massachusetts Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator.

Massachusetts estate tax returns are required if the gross estate plus adjusted taxable gifts computed using the Internal Revenue Code in effect. The federal estate tax exemption is at a historic high in 2019 of 114 million for individuals 228m for couples. Break that threshold and your heirs are liable at a flat rate of 40 of the amount over the.

Census Bureau The Tax Foundation. The Massachusetts estate tax due on her estate according to the table above would be 36560.

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

How Do State And Local Individual Income Taxes Work Tax Policy Center

Your Guide To Navigating The Massachusetts State Estate Tax Law Rockland Trust

State Corporate Income Tax Rates And Brackets Tax Foundation

Massachusetts Estate And Gift Taxes Explained Wealth Management

Oecd Tax Revenue Sources Of Revenue In The Oecd 2022

State Corporate Income Tax Rates And Brackets Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

Massachusetts Who Pays 6th Edition Itep

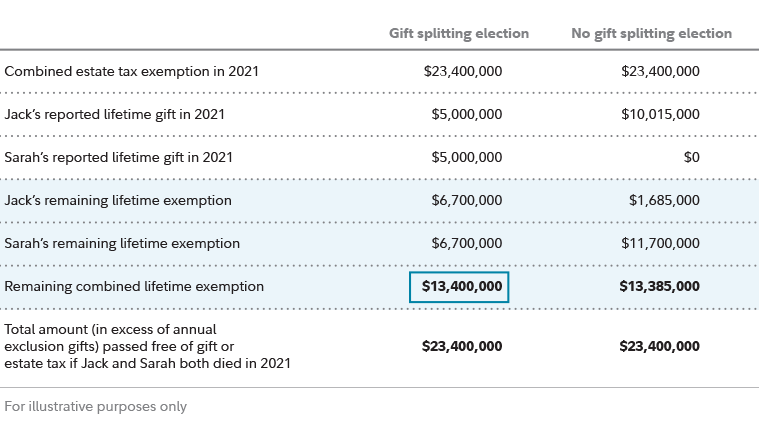

Estate Planning Strategies For Gift Splitting Fidelity

Massachusetts State 2022 Taxes Forbes Advisor

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

How Do State Estate And Inheritance Taxes Work Tax Policy Center

How Can I Avoid The Massachusetts Estate Tax Heritage Law Center

How Is Tax Liability Calculated Common Tax Questions Answered

How Is Tax Liability Calculated Common Tax Questions Answered

Massachusetts Who Pays 6th Edition Itep